Recent Posts

Managing Your Health After a Job Loss or Insurance Change

Losing a job or experiencing a change in health insurance can be overwhelming. Beyond the emotional and financial stress, one of the biggest concerns for many people is how to manage their healthcare needs. Routine check-ups, medications and ongoing treatment for chronic conditions don’t suddenly stop being necessary just because your coverage does.

At St. Hope Healthcare, we understand how disruptive these life changes can be. That’s why we’re committed to helping individuals and families stay connected to quality care, no matter their employment or insurance status.

There Are Affordable Healthcare Options for People Without Insurance

Job loss and insurance changes are more common than you think. Whether due to layoffs, seasonal work, transitions between jobs or losing coverage through a spouse, many Americans find themselves wondering:

- How will I afford my medications?

- Can I still see my doctor?

- What happens if I have an emergency?

- Will I be penalized for skipping appointments?

The good news is you have options, and you don’t have to navigate them alone.

1. Understand the Timing of Your Insurance

If you lost your job, your employer-sponsored health insurance might not end immediately. In many cases:

- Coverage remains active until the end of the month in which your job ended.

- You may qualify for COBRA continuation coverage, which lets you temporarily extend your group coverage (though it can be expensive).

- Losing your job qualifies as a Special Enrollment Period (SEP), giving you 60 days to apply for new coverage through the Affordable Care Act (ACA) Marketplace.

If your insurance changed rather than ended, check your new policy’s effective date, provider network, and covered services as soon as possible.

2. Explore Community-Based Health Clinics

If you’re currently uninsured or facing a gap in coverage, community-based healthcare providers like St. Hope Healthcare can help.

Many community clinics offer:

- Sliding scale fees based on income

- Low-cost or free preventive services

- Support with insurance enrollment and navigating Medicaid

- Access to medications through pharmacy discounts or programs

Whether you’re managing diabetes, need a physical or simply want to stay up to date on vaccines, we believe your care shouldn’t stop just because your job did.

3. Prioritize the Essentials

When times are tight, it’s tempting to cancel as many recurring expenses as possible, but your health should remain a priority. Here’s how to approach care if your budget or coverage is limited:

- Don’t skip refills:

Talk to your provider about generic alternatives or medication assistance programs.

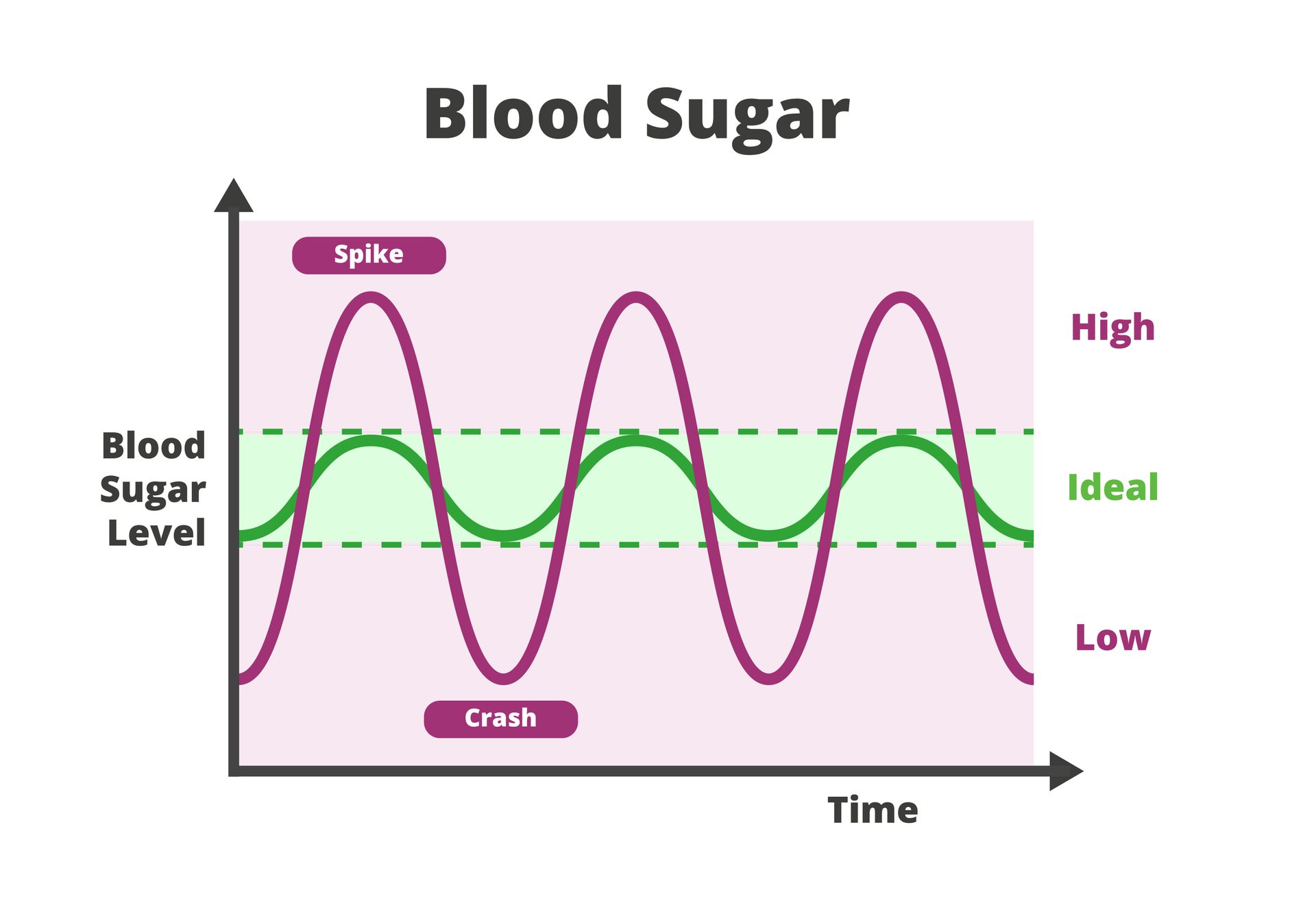

- Manage chronic conditions proactively:

Staying on top of issues like high blood pressure, asthma or mental health prevents emergencies that could result in expensive ER visits.

- Take advantage of telehealth: Virtual visits are often cheaper and more accessible, especially for follow-up care or minor concerns.

Your provider may also be able to schedule fewer appointments spaced out over time or combine multiple needs into a single visit to reduce your costs.

4. Know Your Rights and Resources

You may qualify for additional help through:

- Medicaid: If your income drops significantly, you could be eligible for state-funded health coverage.

- ACA Marketplace Plans: Subsidies may make coverage more affordable than you expect.

- Prescription Discount Programs:

Tools like GoodRx or pharmacy savings cards can dramatically lower medication costs.

- Local nonprofits or health departments: These often provide free screenings, family planning, immunizations and more. Both the Houston Health Department and Harris County Public Health offer low-cost or free community health and wellness services.

At St. Hope Healthcare, our team can walk you through your options and help you apply for coverage or discount programs you may not know about.

5. Stay on Top of Mental Health

Job loss can deeply affect your emotional well-being. It’s common to feel:

- Anxious about the future

- Embarrassed or ashamed

- Depressed or isolated

Your mental health is just as important as your physical health, especially during a major life transition. Don’t wait to seek help. Many clinics, including ours, offer affordable behavioral health services to support you during times of stress and change.

6. Communicate With Your Provider

Don’t let shame or fear stop you from calling your doctor. We’re here to help, not judge. If your situation has changed:

- Let us know so we can adjust your care plan.

- Ask about payment options, sliding scale fees or short-term solutions.

- Request help with insurance navigation. We assist patients every day in finding coverage that fits their needs and budget.

Most importantly, keep us informed about your health. Delaying care could lead to bigger problems down the road.

A Community Healthcare Organization Dedicated to Keeping High-Quality Care Accessible

If you’ve recently lost your job or changed insurance plans, don’t wait to seek help. St. Hope Healthcare offers personalized support to help you stay healthy, stay informed and move forward with confidence. From low-cost primary care and chronic condition management to mental health services and insurance navigation, we’re here when you need us most.

Call (713) 778-1300 or schedule your appointment today here on our website to learn how we can support you and your family.